Organizing personal finances frequently brings to mind thoughts of scarcity or choosing savings over comfort. Nonetheless, cutting expenses doesn’t automatically imply giving up a good quality of life. With careful planning, smart alternatives, and the use of modern resources, numerous people and households manage to reduce their spending while keeping, or even improving, their living standards. This article discusses practical methods, real-world scenarios, and expert opinions aimed at assisting you in reducing costs while still enjoying what is truly important.

1. Reconsidering Needs and Extravagances

Here is the revised text:

The initial phase in cutting expenses involves recognizing your spending behaviors. Start by distinguishing between essential purchases and those deemed as luxuries or routines. For instance, if visiting a coffee shop daily is enjoyable, yet the specific brand or venue isn’t crucial, think about opting for a less expensive café or preparing coffee at home with high-quality beans. Minor adjustments in daily habits can lead to significant yearly savings without experiencing deprivation.

Case Study: In 2019, research revealed that the typical American spends about $1,100 each year on coffee purchased away from home. Those who transitioned to brewing high-quality coffee at home indicated they spent roughly 70% less, yet still relished their morning routine.

2. Improving Memberships and Regular Services

Recurring monthly fees can quietly erode your budget. Streaming services, magazines, gym memberships, cloud storage, and meal kits become financial drains when left unchecked. Conduct a quarterly audit of these subscriptions. Retain only those you actively use and genuinely enhance your well-being.

Practical Example: Rather than signing up for four video streaming services, switch between two each month according to the available shows. Numerous users find they seldom realize what’s missing given the overwhelming variety of options.

3. Smart Grocery Shopping and Meal Planning

Los gastos en comida a menudo se encuentran entre los costos recurrentes más altos. En lugar de comer fuera con frecuencia o comprar de manera impulsiva, elabora un plan de comidas semanal y una lista de compras correspondiente. Elige productos de temporada, marcas genéricas o marcas propias para productos básicos, y compra al por mayor cuando sea conveniente. No caigas en la suposición de que un precio más bajo significa menor calidad, ya que muchas marcas privadas colaboran con proveedores confiables.

Data Point: According to the Bureau of Labor Statistics, households can reduce their grocery expenses by 15-30% by choosing non-premium brands and limiting food wastage through efficient planning.

4. Using Technology to Save Money

Numerous apps and websites track discounts, compare prices, and offer digital coupons. Browser extensions can automatically aggregate and apply discounts during online shopping. Additionally, online tools track utility consumption and suggest cost-saving measures. By tapping into these resources, consumers can maintain product and service quality at a reduced price point.

Expert Insight: “Technology’s role is to empower the consumer. Using digital tools is not about being frugal; it is about making informed choices,” says Dr. Michelle Harper, a personal finance educator.

5. Embracing Experiences Over Material Goods

Research consistently shows that experiences provide greater long-term satisfaction than physical items. By redirecting spend from material acquisition to shared activities—such as local cultural events, nature hikes, or home-hosted gatherings—you enrich your life without inflating the budget. Community resources, including public libraries and municipal recreation centers, offer ample opportunities for enrichment at minimal or no cost.

Survey Insight: According to a 2022 Gallup poll, 72% of respondents reported higher happiness from experiences like travel or concerts than from new possessions.

6. Different Modes of Transportation

Automotive expenses, from fuel to insurance and maintenance, present a significant financial burden. Exploring alternatives, such as using public transit, cycling, or carpooling even a few times per week, can substantially lower costs. Ride-sharing apps enable flexible commuting, while many employers offer transit incentives.

Real-World Example: In metropolitan areas, partial car ownership—where a family owns one car instead of two—can save over $5,000 annually, and studies indicate no substantial impact on mobility with creative planning.

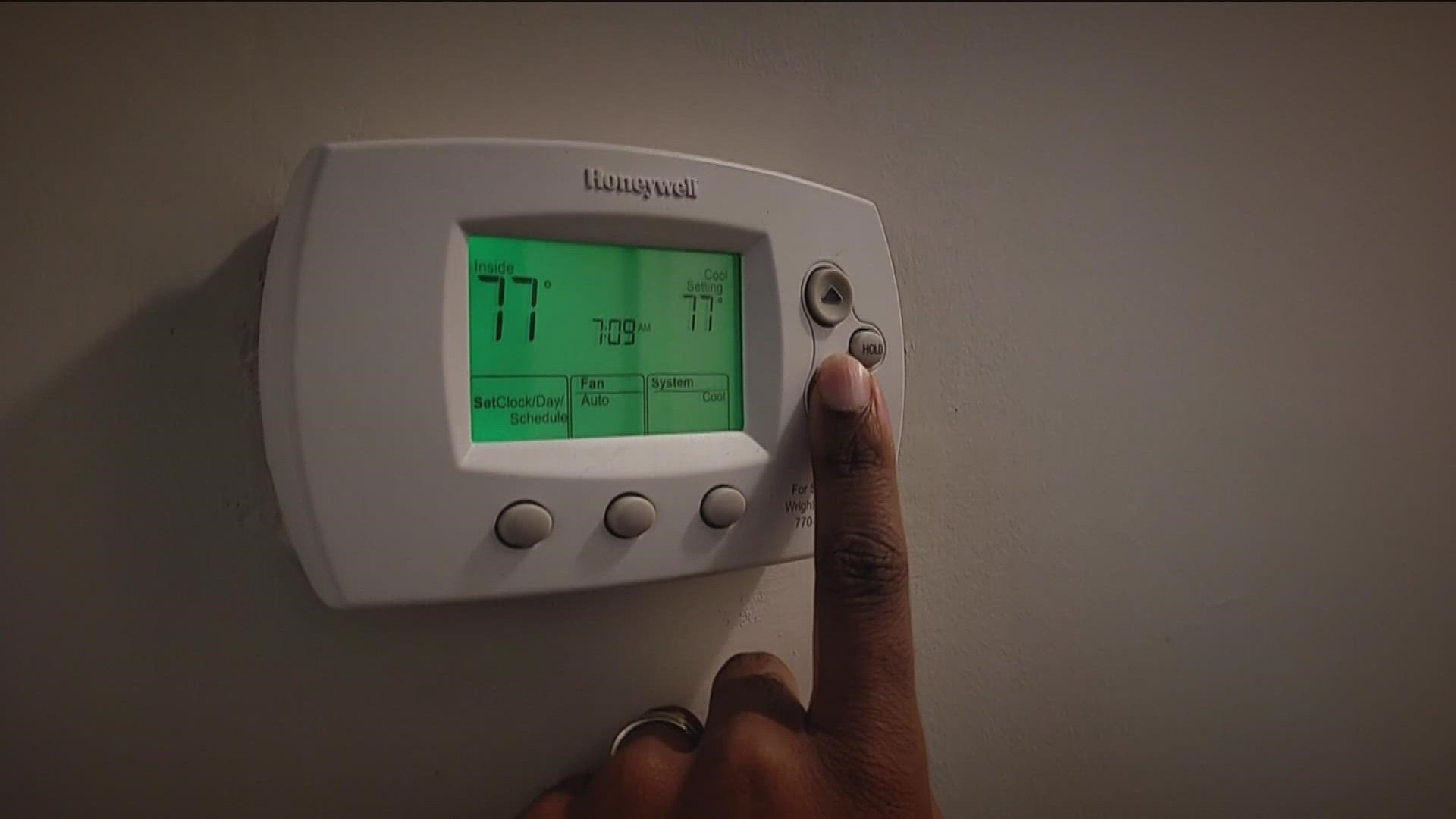

7. Reducing Utility Costs Without Sacrificing Comfort

Energy bills for heating, air conditioning, water, and electricity can be reduced without compromising comfort. Easy adjustments include installing programmable thermostats, transitioning to LED bulbs, disconnecting electronics when idle, and fitting water-efficient fixtures. Conducting energy audits of your home can expose hidden inefficiencies, frequently leading to significant percentage cuts in utility expenses.

Data Example: The Department of Energy notes that setting your thermostat 7-10 degrees Fahrenheit lower for eight hours a day can save up to 10% a year on heating and cooling costs with negligible impact on comfort.

8. Mindful Shopping and Delayed Gratification

Impulse purchases frequently result in acquiring items that do not contribute to one’s quality of life. Introduce a compulsory 48-hour delay for non-essential goods. This waiting period provides the opportunity to evaluate genuine necessity and explore more affordable choices. Numerous individuals discover that their initial want diminishes, or they identify a cheaper alternative.

Tip: Maintain a “wish list” rather than a shopping cart. Items that remain attractive after a cooling-off period are likelier to provide value.

9. Leveraging Local and Peer Support

Sharing resources can significantly cut costs. Tool lending libraries, clothing exchanges, volunteer-operated repair workshops, and shared work or living spaces increase access without a corresponding financial burden. Peer-to-peer platforms additionally enable you to lease or borrow rarely used items, like power tools or sports gear.

Community Insight: In numerous city neighborhoods, tool libraries and community gardens that are maintained together have resulted in considerable personal savings in addition to promoting social bonds.

10. Investing in Preventive Health and Wellness

Health crises and enduring illnesses can burden financial resources and reduce life quality. Focusing on preventive health measures, such as routine medical examinations, immunizations, exercise programs, and stress relief, minimizes future costs and maintains everyday wellness.

Research Insight: The American Public Health Association estimates that every $1 invested in prevention saves $5.60 in future health-related costs. For many, these savings manifest as fewer missed workdays and reduced out-of-pocket health expenses.

Cutting costs can turn into a productive and satisfying journey of challenging long-standing routines and embracing fresh ideas. With a mindful approach, every penny saved signifies more than just moderation—it signifies freedom, offering increased choices, reduced anxiety, and a greater recognition of what truly holds worth. By prioritizing mindful consumption, drawing on the knowledge within your community, and selecting experiences that rejuvenate rather than exhaust, you establish a meaningful, sustainable way of life that relies more on intentionality than expenditure.